10-K: Annual report pursuant to Section 13 and 15(d)

Published on February 11, 2020

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|||||

For the fiscal year ended December 31, 2019

|

|||||

| or | |||||

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|||||

For the transition period from to |

|||||

COMMISSION FILE NUMBER: 001-33988

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. employer identification no.)

|

||||||||||

| , | |||||||||||

(Address of principal executive offices)

|

(Zip Code) | ||||||||||

(770 ) 240-7200

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

| ☑ | Accelerated filer |

☐ | Smaller reporting company |

||||||||||||||

Non-accelerated filer |

☐ | (Do not check if a smaller reporting company) | Emerging growth company |

||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of voting and non-voting common equity held by non-affiliates at June 30, 2019 was approximately $4.1 billion.

As of February 7, 2020 there were approximately 290,324,561 shares of the registrant’s Common Stock, $0.01 par value per share outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

1

TABLE OF CONTENTS OF FORM 10-K

| MINE SAFETY DISCLOSURES | ||||||||

| EXECUTIVE OFFICERS OF THE REGISTRANT | ||||||||

2

INFORMATION CONCERNING FORWARD-LOOKING STATEMENTS

Certain statements regarding the expectations of Graphic Packaging Holding Company (“GPHC” and, together with its subsidiaries, the “Company”), including, but not limited to, the deductibility of goodwill for tax purposes, the availability of net operating losses to offset U.S. federal income taxes and the timing related to the Company's future U.S. federal income tax payments, the anticipated reduction of International Paper Company's investment in Graphic Packaging International Partners, LLC, reclassification of loss on derivative instruments, termination of the U.S. pension plan and charges related thereto, charges associated with CRB mill exit activities, capital investment, depreciation and amortization, interest expense, pension plan contributions and post-retirement health care benefit payments in this report constitute “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Such statements are based on currently available operating, financial and competitive information and are subject to various risks and uncertainties that could cause actual results to differ materially from the Company’s historical experience and its present expectations. These risks and uncertainties include, but are not limited to, inflation of and volatility in raw material and energy costs, changes in consumer buying habits and product preferences, competition with other paperboard manufacturers and converters, product substitution, the Company’s ability to implement its business strategies, including strategic acquisitions, the Company's ability to successfully integrate acquisitions, productivity initiatives and cost reduction plans, the Company’s debt level, currency movements and other risks of conducting business internationally, and the impact of regulatory and litigation matters, including those that could impact the Company’s ability to utilize its net operating losses to offset taxable income and those that impact the Company's ability to protect and use its intellectual property. Additional information regarding these and other risks is contained in Part I, Item 1A., Risk Factors. Undue reliance should not be placed on forward-looking statements, as such statements speak only as of the date on which they are made and the Company undertakes no obligation to update such statements, except as may be required by law.

3

PART I

ITEM 1.BUSINESS

Overview

Graphic Packaging Holding Company (“GPHC” and, together with its subsidiaries, the “Company”) is committed to providing consumer packaging that makes a world of difference. The Company is a leading provider of paper-based packaging solutions for a wide variety of products to food, beverage, foodservice and other consumer products companies. The Company operates on a global basis, is one of the largest producers of folding cartons in the United States ("U.S.") and holds leading market positions in coated-recycled paperboard ("CRB"), coated unbleached kraft paperboard (“CUK”) and solid bleached sulfate paperboard ("SBS").

The Company’s customers include many of the world’s most widely recognized companies and brands with prominent market positions in beverage, food, foodservice and other consumer products. The Company strives to provide its customers with packaging solutions designed to deliver marketing and performance benefits at a competitive cost by capitalizing on its low-cost paperboard mills and converting facilities, its proprietary carton and packaging designs, and its commitment to quality and service.

On January 1, 2018, GPHC, a Delaware corporation, International Paper Company, a New York corporation (“IP”), Graphic Packaging International Partners, LLC, a Delaware limited liability company formerly known as Gazelle Newco LLC and a wholly owned subsidiary of the Company (“GPIP”), and Graphic Packaging International, LLC, a Delaware limited liability company formerly known as Graphic Packaging International, Inc. and a direct subsidiary of GPIP (“GPIL”), completed a series of transactions pursuant to an agreement dated October 23, 2017, among the foregoing parties (the “Transaction Agreement”). Pursuant to the Transaction Agreement (i) a wholly owned subsidiary of the Company transferred its ownership interest in GPIL to GPIP; (ii) IP transferred its North America Consumer Packaging (“NACP”) business to GPIP, which was then subsequently transferred to GPIL; (iii) GPIP issued membership interests to IP, and IP was admitted as a member of GPIP; and (iv) GPIL assumed certain indebtedness of IP (the "NACP Combination").

GPI Holding III, LLC, an indirect wholly-owned subsidiary of the Company (“GPI Holding”), is the managing member of GPIP.

At the closing of the NACP Combination, GPIP issued 309,715,624 common units or 79.5% of the membership interests in GPIP to GPI Holding and 79,911,591 common units or 20.5% of the membership interests in GPIP to IP. Subject to certain restrictions, the common units held by IP are exchangeable into shares of common stock of GPHC or cash.

4

The following diagram illustrates the organization of the Company immediately subsequent to the transactions described above (not including subsidiaries of GPIL):

During 2019 and 2018, GPIP repurchased 20.8 million partnership units from GPI Holding, which increased IP's ownership interest in GPIP to 21.6% at December 31, 2019. The Company used the proceeds from these repurchases to repurchase 20.8 million shares of its common stock.

On January 28, 2020, the Company announced that IP notified the Company of its intent to begin the process of reducing its ownership interest in GPIP. Per the agreement between the parties, on January 29, 2020, GPIP purchased 15.1 million partnership units from IP for $250 million. As a result, IP’s ownership interest in GPIP decreased from 21.6% to 18.3%.

Unless otherwise negotiated by the parties, IP’s next opportunity to exchange their partnership units is 180 days from the purchase date and is limited to the lesser of $250 million or 25% of the units owned. IP will have further opportunities to exchange their partnership units 180 days after each exchange date. The Company may choose to satisfy these exchanges using shares of its common stock, cash, or a combination thereof.

Acquisitions and Dispositions

Over the past five years, the Company has successfully completed over ten acquisitions and expects to pursue strategic acquisition opportunities in the future as part of its overall growth strategy.

5

2019

On August 1, 2019, the Company acquired substantially all the assets of Artistic Carton Company ("Artistic"), a diversified producer of folding cartons and CRB. The acquisition included two converting facilities located in Auburn, Indiana and Elgin, Illinois (included in the Americas Paperboard Packaging reportable segment) and one CRB mill located in White Pigeon, Michigan (included in the Paperboard Mills reportable segment).

2018

On September 30, 2018, the Company acquired substantially all the assets of the foodservice business of Letica Corporation, a subsidiary of RPC Group PLC ("Letica Foodservice"), a producer of paperboard-based cold and hot cups and cartons. The acquisition included two facilities located in Clarksville, Tennessee and Pittston, Pennsylvania. Letica Foodservice assets are included in the Americas Paperboard Packaging reportable segment.

On August 31, 2018, the Company sold its previously closed CRB mill site in Santa Clara, California.

On June 12, 2018, the Company acquired substantially all the assets of PFP, LLC and its related entity, PFP Dallas Converting, LLC (collectively, "PFP"), a converter focused on the production of paperboard based air filter frames. The acquisition included two facilities located in Lebanon, Tennessee and Lancaster, Texas. PFP assets are included in the Americas Paperboard Packaging reportable segment.

As mentioned above, on January 1, 2018, the Company completed the NACP Combination. The NACP business produces SBS paperboard and paper-based foodservice products. The NACP business included two SBS mills located in Augusta, Georgia and Texarkana, Texas (included in Paperboard Mills reportable segment), three converting facilities in the U.S. (included in the Americas Paperboard Packaging reportable segment) and one in the United Kingdom ("U.K.") (included in the Europe Paperboard Packaging reportable segment).

PFP and Letica Foodservice are referred to collectively as the "2018 Acquisitions."

2017

On December 1, 2017, the Company acquired the assets of Seydaco Packaging Corp. and its affiliates, National Carton and Coating Co., and Groupe Ecco Boites Pliantes Ltée (collectively, "Seydaco"), a folding carton producer focused on the foodservice, food, personal care, and household goods markets. The acquisition included three folding carton facilities located in Mississauga, Ontario, St.-Hyacinthe, Québec, and Xenia, Ohio.

On December 1, 2017, the Company closed its coated recycled paperboard mill in Santa Clara, California. This decision was made as a result of a thorough assessment of the facility's manufacturing capabilities and associated costs in the context of the Company's overall mill operating capabilities and cost structure.

On October 4, 2017, the Company acquired Norgraft Packaging, S.A. ("Norgraft"), a leading folding carton producer in Spain focused on the food and household goods markets. The acquisition included two folding carton facilities located in Miliaño and Requejada, Spain.

On July 10, 2017, the Company acquired substantially all the assets of Carton Craft Corporation and its affiliate, Lithocraft, Inc. (collectively, "Carton Craft"). The acquisition included two folding carton facilities located in New Albany, Indiana, focused on the production of paperboard-based air filter frames and folding cartons.

The Seydaco, Norgraft, and Carton Craft transactions are referred to collectively as the "2017 Acquisitions." Seydaco and Carton Craft are included in the Americas Paperboard Packaging Segment. Norgraft is included in the Europe Paperboard Packaging Segment.

Capital Allocation Plan

On January 28, 2019, the Company's board of directors authorized an additional share repurchase program to allow the Company to purchase up to $500 million of the Company's issued and outstanding shares of common stock through open market purchases, privately negotiated transactions and Rule 10b5-1 plans (the "2019 share repurchase program"). Two previous $250 million share repurchase programs were authorized on January 10, 2017 and February 4, 2015 (the "2017 share repurchase program" and the "2015 share repurchase program," respectively).

6

The following presents the Company's share repurchases for the years ended December 31, 2019, 2018, and 2017:

| Amount repurchased in millions | Amount Repurchased | Number of Shares Repurchased | Average Price | |||||||||||

| 2019 | $ | 127.9 | 10,191,257 | (a) |

$ | 12.55 | ||||||||

| 2018 | $ | 120.0 | 10,566,144 | $ | 11.35 | |||||||||

| 2017 | $ | 58.4 | 4,462,263 | (b) |

$ | 13.08 | ||||||||

(a) Includes 7,400,171 shares under the 2017 share repurchase program thereby completing that program.

(b) Includes 1,440,697 shares under the 2015 share repurchase program thereby completing that program.

At December 31, 2019, the Company had approximately $462 million of share repurchase authority remaining under the 2019 share repurchase program.

During 2019 and 2018, the Company paid cash dividends of $88.7 million and $93.1 million, respectively.

Products

The Company reports its results in three reportable segments as follows:

Paperboard Mills includes the nine North American paperboard mills which produce primarily CRB, CUK, and SBS, which is primarily consumed internally to produce paperboard packaging for the Americas and Europe Paperboard Packaging segments. The remaining paperboard is sold externally to a wide variety of paperboard packaging converters and brokers.

Americas Paperboard Packaging includes paperboard packaging, primarily folding cartons, sold primarily to Consumer Packaged Goods ("CPG") companies, and cups, lids and food containers sold primarily to foodservice companies and quick-service restaurants ("QSR"), all serving the food, beverage, and consumer product markets in the Americas.

Europe Paperboard Packaging includes paperboard packaging, primarily folding cartons, sold primarily to CPG companies serving the food, beverage and consumer product markets in Europe.

The Company operates in three geographic areas: the Americas, Europe and Asia Pacific.

For reportable segment and geographic area information for each of the last three fiscal years, see Note 16 in the Notes to Consolidated Financial Statements included herein under “Item 8. Financial Statements and Supplementary Data."

Paperboard Packaging

The Company’s paperboard packaging products deliver brand, marketing and performance benefits at a competitive cost. The Company supplies paperboard cartons, carriers and containers designed to protect and hold products while providing:

• convenience through ease of carrying, storage, delivery, dispensing of product and food preparation for consumers;

• a smooth surface printed with high-resolution, multi-color graphic images that help improve brand awareness and visibility of products on store shelves; and

• durability, stiffness and wet and dry tear strength; leak, abrasion and heat resistance; barrier protection from moisture, oxygen, oils and greases, as well as enhanced microwave heating performance.

The Company provides a wide range of paperboard packaging solutions for the following end-use markets:

• beverage, including beer, soft drinks, energy drinks, teas, water and juices;

• food, including cereal, desserts, frozen, refrigerated and microwavable foods and pet foods;

• prepared food and drinks, including snacks, quick-serve food and drinks for restaurants and food service providers;

• household products, including dishwasher and laundry detergent, health care and beauty aids, and tissues and papers; and

• air filter frames.

The Company’s packaging applications meet the needs of its customers for:

Strength Packaging. The Company's products provide sturdiness to meet a variety of packaging needs, including tear and wet strength, puncture resistance, durability and compression strength (providing stacking strength to meet store display packaging requirements).

7

Promotional Packaging. The Company offers a broad range of promotional packaging options that help differentiate its customers’ products in the marketplace. These promotional enhancements improve brand awareness and visibility on store shelves.

Convenience Packaging. These packaging solutions improve package usage and food preparation

• beverage multiple-packaging — multi-packs for beer, soft drinks, energy drinks, teas, water and juices;

• active microwave technologies — substrates that improve the heating and browning of foods in the microwave; and

• easy opening and closing features — dispensing features, pour spouts and sealable liners.

Barrier Packaging. The Company provides packages that protect against moisture, temperature (hot and cold), grease, oil, oxygen, sunlight, insects and other potential product-damaging factors.

Paperboard Mills and Folding Carton Facilities

The Company produces paperboard at its mills; prints, cuts, folds, and glues (“converts”) the paperboard into folding cartons and containers at its converting plants; and designs and manufactures specialized, proprietary packaging machines that package bottles and cans and, to a lesser extent, non-beverage consumer products. The Company also installs its packaging machines at customer plants and provides support, service and advanced performance monitoring of the machines.

The Company offers a variety of laminated, coated and printed packaging structures that are produced from its CRB, CUK and SBS mills, as well as other grades of paperboard that are purchased from third-party suppliers.

Below is the production at each of the Company’s paperboard mills during 2019:

| Location | Product | # of Machines | 2019 Net Tons Produced | ||||||||

West Monroe, LA |

CUK | 2 | 910,759 | ||||||||

Macon, GA |

CUK | 2 | 708,496 | ||||||||

Kalamazoo, MI |

CRB | 2 | 493,130 | ||||||||

Battle Creek, MI |

CRB | 2 | 210,673 | ||||||||

Middletown, OH |

CRB | 1 | 169,475 | ||||||||

East Angus, Québec |

CRB | 1 | 97,921 | ||||||||

White Pigeon, MI (a)

|

CRB | 1 | 28,025 | ||||||||

Texarkana, TX |

SBS | 2 | 607,330 | ||||||||

Augusta, GA |

SBS | 2 | 583,147 | ||||||||

West Monroe, LA |

Corrugated Medium | 1 | 121,929 | ||||||||

(a) Indicates net tons produced from August to December.

The Company consumes most of its coated board output in its converting operations, which is an integral part of the customer value proposition. In 2019, approximately 68% of combined mill sales of CRB, CUK and SBS was consumed internally.

CRB Production. The Company is the largest North American producer of CRB. CRB is manufactured entirely from recycled fibers, primarily old corrugated containers (“OCC”), doubled-lined kraft cuttings from corrugated box plants (“DLK”), old newspapers (“ONP”), and box cuttings. The recycled fibers are re-pulped, formed on paper machines, and clay-coated to provide an excellent printing surface for superior quality graphics and appearance characteristics.

CUK Production. The Company is the largest of four worldwide producers of CUK. CUK is manufactured from pine-based wood fiber and is a specialized high-quality grade of coated paperboard with excellent wet and dry tear strength characteristics and printability for high resolution graphics that make it particularly well-suited for a variety of packaging applications. Both wood and recycled fibers are pulped, formed on paper machines, and clay-coated to provide an excellent printing surface for superior quality graphics and appearance characteristics.

SBS Production. The Company is one of the largest North American producers of SBS. SBS is manufactured from bleached pine and hardwood-based wood fiber and is the highest quality paperboard substrate with excellent wet and dry strength characteristics and superior printability for high-end packaging. Both wood and recycled fibers are pulped, formed on paper machines, and clay-coated to provide an excellent printing surface for superior quality graphics and appearance characteristics. SBS is also coated with polyethylene resin for wet strength liquid and food packaging end uses.

8

Corrugated Medium. The Company manufactures corrugated medium for internal use and sale in the open market. Corrugated medium is combined with linerboard to make corrugated containers.

The Company converts CRB, CUK and SBS, as well as other grades of paperboard, into cartons and containers at converting plants the Company operates in various locations globally, including a converting plant associated with the Company's joint venture in Japan, contract converters and at licensees outside the U.S. The converting plants print, cut, fold and glue paperboard into cartons and containers designed to meet customer specifications.

Joint Venture

The Company, through its GPIL subsidiary, is a party to a Japanese joint venture, Rengo Riverwood Packaging, Ltd. in which it holds a 50% ownership interest. The joint venture agreement covers CUK supply, use of proprietary carton designs and marketing and distribution of packaging systems.

Marketing and Distribution

The Company markets its products principally to multinational beverage, food, QSR, and other well-recognized consumer product companies. The beverage companies include Anheuser-Busch, Inc., MillerCoors LLC, PepsiCo, Inc. and The Coca-Cola Company, among others. Consumer product customers include Kraft Heinz Company, General Mills, Inc., Nestlé USA, Inc., Kellogg Company, HAVI Global Solutions, LLC and Kimberly-Clark Corporation, among others. QSR customers include McDonald's, Wendy's, Panda Express, Dairy Queen, Chipotle, Panera and Kentucky Fried Chicken, among others. The Company also sells paperboard in the open market to independent and integrated paperboard converters.

Distribution of the Company’s principal products is primarily accomplished through sales offices in the U.S., Australia, Brazil, China, France, Germany, Italy, Japan, Mexico, Spain, the Netherlands and the United Kingdom, and, to a lesser degree, through broker arrangements with third parties.

During 2019 and 2018, the Company did not have any one customer that represented 10% or more of its net sales.

Competition

Although a relatively small number of large competitors hold a significant portion of the paperboard packaging market, the Company’s business is subject to strong competition. The Company and WestRock Company ("WestRock") are the two major CUK producers in the U.S. Internationally, The Klabin Company in Brazil and Stora Enso in Sweden produce similar grades of paperboard.

In non-beverage consumer packaging and foodservice, the Company’s paperboard competes with WestRock CUK, as well as CRB and SBS from numerous competitors, and, internationally, folding boxboard and white-lined chip. There are a large number of producers in the paperboard markets. Suppliers of paperboard compete primarily on the basis of price, strength and printability of their paperboard, quality and service.

In beverage packaging, cartons made from CUK compete with substitutes such as plastics and corrugated packaging for packaging glass or plastic bottles, cans and other primary containers. Although plastics and corrugated packaging may be priced lower than CUK, the Company believes that cartons made from CUK offer advantages over these materials in areas such as distribution, brand awareness, carton designs, package performance, package line speed, environmental friendliness and design flexibility.

Raw Materials

The paperboard packaging produced by the Company comes from pine and hardwood trees and recycled fibers. Pine pulpwood, hardwood pulp, paper and recycled fibers (including DLK, OCC and ONP) and energy used in the manufacture of paperboard, as well as poly sheeting, plastic resins and various chemicals used in the coating of paperboard, represent the largest components of the Company’s variable costs of paperboard production.

For the West Monroe, LA, Macon, GA, Texarkana, TX, and Augusta, GA mills, the Company relies on private landowners and the open market for all of its pine and hardwood pulp and recycled fiber requirements, supplemented by clippings that are obtained from its converting operations. The Company believes that adequate supplies from both private landowners and open market fiber sellers currently are available in close proximity to meet its fiber needs at these mills.

The paperboard grades produced at the Kalamazoo, MI, Battle Creek, MI, Middletown, OH, East Angus, Quebec and White Pigeon, MI mills are made from 100% recycled fiber. The Company procures its recycled fiber from external suppliers and internal converting operations. The market price of each of the various recycled fiber grades fluctuates with supply and demand. The Company’s internal recycled fiber procurement function enables the Company to pay lower prices for its recycled fiber needs given the Company’s highly fragmented supplier base. The Company believes there are adequate supplies of recycled fiber to serve its mills.

9

In North America, the Company also converts a variety of other paperboard grades, in addition to paperboard that is supplied to its converting operations from its own mills. The Company purchases such paperboard requirements, including additional CRB and SBS, from outside vendors. The majority of external paperboard purchases are acquired through long-term arrangements with other major industry suppliers. The Company's European converting plants consume CUK supplied from the Company's mills and also convert other paperboard grades such as white-lined chip and folding box board purchased from external suppliers.

Energy

Energy, including natural gas, fuel oil and electricity, represents a significant portion of the Company’s manufacturing costs. The Company has entered into contracts designed to manage risks associated with future variability in cash flows and price risk related to future energy cost increases for a portion of its natural gas requirements at its U.S. mills. The Company’s hedging program for natural gas is discussed in Note 10 in the Notes to Consolidated Financial Statements included herein under “Item 8., Financial Statements and Supplementary Data.”

Backlog

Orders from the Company’s principal customers are manufactured and shipped with minimal lead time. The Company did not have a material amount relating to backlog orders at December 31, 2019 or 2018.

Seasonality

The Company’s net sales, income from operations and cash flows from operations are subject to moderate seasonality, with demand usually increasing in the late spring through early fall due to increases in demand for beverage and food products.

Research and Development

The Company’s research and development team works directly with its sales, marketing and consumer insights personnel to understand long-term consumer and retailer trends and create relevant new packaging. These innovative solutions provide customers with differentiated packaging to meet customer needs. The Company’s development efforts include, but are not limited to, extending the shelf life of customers’ products; reducing production and waste costs; enhancing the heat-managing characteristics of food packaging; improving the sturdiness and compression strength of packaging to meet store display needs; and refining packaging appearance through new printing techniques and materials.

Sustainability represents one of the strongest trends in the packaging industry and the Company focuses on developing more sustainable and eco-friendly manufacturing processes and products. The Company’s strategy is to combine sustainability with innovation to create new packaging solutions for its customers.

For more information on research and development expenses see Note 1 in the Notes to Consolidated Financial Statements included herein under “Item 8., Financial Statements and Supplementary Data.”

Patents and Trademarks

As of December 31, 2019, the Company had a large patent portfolio, presently owning, controlling or holding rights to more than 2,400 U.S. and foreign patents, with more than 450 U.S. and foreign patent applications currently pending. The Company’s patent portfolio consists primarily of patents relating to packaging machinery, manufacturing methods, structural carton designs, active microwave packaging technology and barrier protection packaging. These patents and processes are significant to the Company’s operations and are supported by trademarks such as Fridge Vendor™, IntegraPak™, Keel Clip™, MicroFlex-Q™, MicroRite™, Quilt Wave™, Qwik Crisp™, Tite-Pak™, and Z-Flute™. The Company takes significant steps to protect its intellectual property and proprietary rights.

Culture and Employees

The Company’s corporate vision — Inspired packaging. A world of difference. — and values of integrity, respect, accountability, relationships and teamwork guide employee behavior, expectations and relations. The Company’s ongoing efforts to build a high-performance culture and improve the manner in which work is done across the Company includes a significant focus on continuous improvement utilizing processes like Lean Sigma and Six Sigma.

As of December 31, 2019, the Company had approximately 18,000 employees worldwide, of which approximately 41% were represented by labor unions and covered by collective bargaining agreements or covered by works councils in Europe. As of December 31, 2019, 422 of the Company’s employees were working under expired contracts, which are currently being negotiated, and 1,813 were covered under collective bargaining agreements that expire within one year. The Company considers its employee relations to be satisfactory.

10

Environmental Matters

The Company is subject to a broad range of foreign, federal, state and local environmental regulations and employs a team of professionals in order to maintain compliance at each of its facilities. In 2019, the Company spent approximately $7 million of capital on projects to maintain compliance with environmental laws, regulations and the Company’s permits granted thereunder. In 2020, 2021, and 2022, the Company estimates it will spend approximately $10 million, $25 million and $35 million, respectively, for such projects, primarily the waste water treatment system upgrades at the Augusta, Georgia and Texarkana, Texas mills. For additional information on such regulation and compliance, see “Environmental Matters” in “Item 7., Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 14 in the Notes to Consolidated Financial Statements included herein under “Item 8., Financial Statements and Supplementary Data.”

Available Information

The Company’s website is located at http://www.graphicpkg.com. The Company makes available, free of charge through its website, its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after such materials are electronically filed or furnished to the Securities and Exchange Commission (the “SEC”). The Company also makes certain investor presentations and access to analyst conference calls available through its website. The information contained or incorporated into the Company’s website is not a part of this Annual Report on Form 10-K.

The SEC maintains an Internet website that contains reports, proxy and information statements, and other information regarding issuers like the Company that file electronically with the SEC at http://www.SEC.gov.

11

ITEM 1A. RISK FACTORS

The following risks could affect (and in some cases have affected) the Company's actual results and could cause such results to differ materially from estimates or expectations reflected in certain forward-looking statements:

The Company's financial results could be adversely impacted if there are significant increases in prices for raw materials, energy, transportation and other necessary supplies, and the Company is unable to raise prices, or improve productivity to reduce costs.

Limitations on the availability of, and increases in, the costs of raw materials, including secondary fiber, petroleum-based materials, energy, wood, transportation and other necessary goods and services, could have an adverse effect on the Company's financial results. Because negotiated sales contracts and the market largely determine the pricing for its products, the Company is at times limited in its ability to raise prices and pass through to its customers any inflationary or other cost increases that the Company may incur.

The Company uses productivity improvements to reduce costs and offset inflation. These include global continuous improvement initiatives that use statistical process control to help design and manage many types of activities, including production and maintenance. The Company's ability to realize anticipated savings from these improvements is subject to significant operational, economic and competitive uncertainties and contingencies, many of which are beyond the Company's control. If the Company cannot successfully implement cost savings plans, it may not be able to continue to compete successfully against other manufacturers. In addition, any failure to generate the anticipated efficiencies and savings could adversely affect the Company's financial results.

Changes in consumer buying habits and preferences for products could have an effect on our sales volumes.

Changing consumer dietary habits and preferences have slowed sales growth for many of the food and beverage products the Company packages. If these trends continue, the Company’s financial results could be adversely affected.

Competition and product substitution could have an adverse effect on the Company's financial results.

The Company competes with other paperboard manufacturers and carton converters, both domestically and internationally. The Company's products compete with those made from other manufacturers' CUK, as well as SBS and CRB, and other board substrates. Substitute products include plastic, shrink film and corrugated containers. In addition, while the Company has long-term relationships with many of its customers, the underlying contracts may be re-bid or renegotiated from time to time, and the Company may not be successful in renewing such contracts on favorable terms or at all. The Company works to maintain market share through efficiency, product innovations and strategic sourcing to its customers; however, pricing and other competitive pressures may occasionally result in the loss of a customer relationship.

The Company's future growth and financial results could be adversely impacted if the Company is unable to identify strategic acquisitions and to successfully integrate the acquired businesses.

The Company has made a significant number of acquisitions in recent years, including the NACP Combination, and expects to make additional strategic acquisitions in the future as part of its overall growth strategy. The Company's ability to continue to make strategic acquisitions from time to time and to integrate the acquired businesses successfully, including obtaining anticipated cost savings or synergies and expected operating results within a reasonable period of time, is an important factor in the Company's future growth. If the Company is unable to properly estimate, account for and realize the expected revenue and cash flow growth and other benefits from its acquisitions, the Company may be required to spend additional time or money on integration efforts that would otherwise have been spent on the development and expansion of its business.

The Company may not be able to develop and introduce new products and adequately protect its intellectual property and proprietary rights, which could harm its future success and competitive position.

The Company works to increase market share and profitability through product innovation and the introduction of new products. The inability to develop new or better products that satisfy customer and consumer preferences in a timely manner may impact the Company's competitive position.

The Company's future success and competitive position also depends, in part, upon its ability to obtain and maintain protection for certain proprietary carton and packaging machine technologies used in its value-added products, particularly those incorporating the Fridge Vendor, IntegraPak, Keel Clip, MicroFlex-Q, MicroRite, Quilt Wave, Qwik Crisp, Tite-Pak, and Z-Flute technologies. Failure to protect the Company's existing intellectual property rights may result in the loss of valuable technologies or may require it to license other companies' intellectual property rights. It is possible that any of the patents owned by the Company may be invalidated, rendered unenforceable, circumvented, challenged or licensed to others or any of its pending or future patent applications may not be issued within the scope of the claims sought by the Company, if at all. Further, others may develop technologies that are similar or superior to the Company's technologies, duplicate its technologies or design around its patents, and steps taken by the Company to protect its technologies may not prevent misappropriation of such technologies.

12

The Company's capital spending may not achieve the desired benefits, which could adversely impact future financial results.

The Company invests significant amounts of cash on capital projects each year which have expected returns to the Company. The Company's ability to execute on these projects in order to achieve planned outcomes, including obtaining expected returns and strategic long-term goals within a reasonable period of time, is an important factor in the Company's financial results and commitments to the market. As these investments start up, the Company may experience unanticipated business disruptions and not achieve the desired benefits or timelines. In addition, the Company's acquisitions may require more capital than expected to achieve synergies or expected operating results. Additional spending and unachieved benefits may adversely affect the Company's cash flow and results of operations.

The Company may face a shortage of a skilled workforce at its facilities.

The Company's ability to maintain or expand its business depends on attracting, training and retaining a skilled workforce. Changing demographics and workforce trends may result in a loss of knowledge and skills as experienced workers retire. Failure to attract and retain a skilled workforce may result in operational inefficiencies or require additional capital investments to reduce reliance on labor, which may adversely impact the Company's results.

The Company could experience material disruptions at our facilities.

Although the Company takes appropriate measures to minimize the risk and effect of material disruptions to the business conducted at our facilities, natural disasters such as hurricanes, tornadoes, floods and fires, as well as other unexpected disruptions such as the unavailability of critical raw materials, power outages and equipment failures can reduce production and increase manufacturing costs. These types of disruptions could materially adversely affect our earnings, depending upon the duration of the disruption and our ability to shift business to other facilities or find other sources of materials or energy. Any losses due to these events may not be covered by our existing insurance policies or may be subject to certain deductibles. In addition, given the Company's integrated supply chain, managing board supply and properly planning for mill outages and downtime must be integrated with the converting plants forecast. Any inability to do so could adversely affect the Company's financial results.

The Company is subject to the risks of doing business in foreign countries.

The Company has converting plants and one paper mill in 11 countries outside of the U.S. and sells its products worldwide. For 2019, before intercompany eliminations, net sales from operations outside of the U.S. represented approximately 20% of the Company’s net sales. The Company’s revenues from foreign sales fluctuate with changes in foreign currency exchange rates. The Company pursues a currency hedging program in order to reduce the impact of foreign currency exchange fluctuations on financial results. In addition, at December 31, 2019, approximately 17% of the Company's total assets were denominated in currencies other than the U.S. dollar.

The Company is also subject to the following significant risks associated with operating in foreign countries:

•Compliance with and enforcement of environmental, health and safety and labor laws and other regulations of the foreign countries in which the Company operates;

•Export compliance;

•Imposition or increase of withholding and other taxes on remittances and other payments by foreign subsidiaries; and

•Imposition of new or increases in capital investment requirements and other financing requirements by foreign governments.

In addition to these general risks, uncertainties surrounding the United Kingdom’s pending withdrawal from the European Union (commonly referred to as “Brexit”) could adversely affect our U.K. business, including potentially the Company's relationships with customers, suppliers and employees. The effects of Brexit will depend on the agreements, if any, the U.K. makes to retain access to European markets either during a transition period or more permanently.

The Company’s information technology systems could suffer interruptions, failures or breaches and our business operations could be disrupted adversely affecting results of operations and the Company’s reputation.

The Company’s information technology systems, some of which are dependent on services provided by third parties, serve an important role in the operation of the business. These systems could be damaged or cease to function properly due to any number of causes, such as catastrophic events, power outages, security breaches, computer viruses or cyber-based attacks. The Company has contingency plans in place to prevent or mitigate the impact of these events, however, if they are not effective on a timely basis, business interruptions could occur which may adversely impact results of operations.

13

The Company has been, and likely will continue to be, subject to computer hacking, acts of vandalism or theft, malware, computer viruses or other malicious codes, phishing, employee error or malfeasance, catastrophes, unforeseen events or other cyber-attacks. To date, the Company has seen no material impact on our business or operations from these attacks or events. Any future significant compromise or breach of data security, whether external or internal, or misuse of customer, associate, supplier or Company data, could result in significant costs, lost sales, fines, lawsuits, and damage to the Company's reputation. However, the ever-evolving threats mean the Company and its third-party service providers and vendors must continually evaluate and adapt their respective systems and processes and overall security environment, as well as those of any companies acquired. There is no guarantee that these measures will be adequate to safeguard against all data security breaches, system compromises or misuses of data. In addition, as the regulatory environment related to information security, data collection and use, and privacy becomes increasingly rigorous, with new and constantly changing requirements applicable to the Company's business. Compliance with such requirements could also result in additional costs.

The Company is subject to environmental, health and safety laws and regulations, and costs to comply with such laws and regulations, or any liability or obligation imposed under new laws or regulations, could negatively impact its financial condition and results of operations.

The Company is subject to a broad range of foreign, federal, state and local environmental, health and safety laws and regulations, including those governing discharges to air, soil and water, the management, treatment and disposal of hazardous substances, the investigation and remediation of contamination resulting from releases of hazardous substances, and the health and safety of employees. The Company cannot currently assess the impact that future emission standards, climate control initiatives and enforcement practices will have on the Company's operations and capital expenditure requirements. Environmental liabilities and obligations may result in significant costs, which could negatively impact the Company's financial position, results of operations or cash flows. See Note 14 in the Notes to Consolidated Financial Statements included herein under “Item 8., Financial Statements and Supplementary Data.”

The Company's indebtedness may adversely affect its financial condition and its ability to react to changes in its business.

As of December 31, 2019, the Company had an aggregate principal amount of $2,872.8 million of outstanding debt.

Because of the Company's debt level, a portion of its cash flows from operations is dedicated to payments on indebtedness and the Company's ability to obtain additional financing for working capital, capital expenditures, acquisitions or general corporate purposes may be restricted in the future.

Additionally, the Company’s Amended and Restated Credit Agreement, Term Loan Credit Agreement and the indentures governing the 4.75% Senior Notes due 2021, 4.875% Senior Notes due 2022, 4.125% Senior Notes due 2024 and 4.75% Senior Notes due 2027 (the “Indentures”) may prohibit or restrict, among other things, the disposal of assets, the incurrence of additional indebtedness (including guarantees), the incurrence of liens, payment of dividends, share repurchases, the making of acquisitions and other investments and certain other types of transactions. These restrictions could limit the Company’s flexibility to respond to changing market conditions and competitive pressures. The debt obligations and restrictions may also leave the Company more vulnerable to a downturn in general economic conditions or its business, or unable to carry out capital expenditures that are necessary or important to its growth strategy and productivity improvement programs.

As of December 31, 2019, approximately 34% of the Company’s debt is subject to variable rates of interest and exposes the Company to increased debt service obligations in the event of increased market interest rates.

ITEM 1B.UNRESOLVED STAFF COMMENTS

None.

14

ITEM 2. PROPERTIES

Headquarters

The Company leases its principal executive offices in Atlanta, GA.

Operating Facilities

A listing of the principal properties owned or leased and operated by the Company is set forth below. The Company’s buildings are adequate and suitable for the business of the Company and have sufficient capacity to meet current requirements. The Company also leases certain smaller facilities, warehouses and office space throughout the U.S. and in foreign countries from time to time.

| Location | Related Products or Use of Facility | ||||

Mills: |

|||||

Augusta, GA |

SBS | ||||

Battle Creek, MI |

CRB | ||||

East Angus, Québec |

CRB | ||||

Kalamazoo, MI |

CRB | ||||

Macon, GA |

CUK | ||||

Middletown, OH |

CRB | ||||

Texarkana, TX |

SBS | ||||

West Monroe, LA |

CUK; Corrugated Medium; Research and Development | ||||

White Pigeon, MI |

CRB | ||||

Other: |

|||||

Atlanta, GA(a)

|

Headquarters, Research and Development, Packaging Machinery and Design | ||||

Concord, NH(a)

|

Research and Development, Design Center | ||||

Crosby, MN |

Packaging Machinery Engineering, Design and Manufacturing | ||||

Louisville, CO(a)

|

Research and Development | ||||

Menomonee Falls, WI |

Foodservice Rebuild Center | ||||

15

North American Converting Plants: |

International Converting Plants: |

|||||||

Atlanta, GA(a)

|

Monterrey, Mexico(a)

|

Auckland, New Zealand(a)

|

||||||

Auburn, IN |

New Albany, IN(b)

|

Bremen, Germany(a)

|

||||||

Carol Stream, IL |

Newton, IA |

Bristol, United Kingdom |

||||||

Centralia, IL |

North Portland, OR |

Coalville, United Kingdom(a)

|

||||||

Charlotte, NC |

Oroville, CA(a)

|

Gateshead, United Kingdom(a)

|

||||||

Clarksville, TN |

Pacific, MO |

Hoogerheide, Netherlands |

||||||

Cobourg, Ontario(a)

|

Perry, GA |

Newcastle Upon Tyne, United Kingdom(a)

|

||||||

Elgin, IL |

Pittston, PA |

Igualada, Spain |

||||||

Elk Grove, IL(a)(b)

|

Prosperity, SC |

Jundiai, Sao Paulo, Brazil |

||||||

Fort Smith, AR(b)

|

Queretaro, Mexico(a)

|

Leeds, United Kingdom |

||||||

Gordonsville, TN(a)

|

Shelbyville, IL |

Masnieres, France(a)

|

||||||

Gresham, OR(a)

|

Solon, OH |

Melbourne, Australia(a)

|

||||||

Hamel, MN |

Staunton, VA |

Miliaño, Spain |

||||||

Irvine, CA |

St.-Hyacinthe, Québec(a)

|

Portlaoise, Ireland(a)

|

||||||

Kalamazoo, MI |

Tijuana, Mexico(a)

|

Requejada, Spain |

||||||

Kendallville, IN |

Tuscaloosa, AL |

Sneek, Netherlands |

||||||

Kenton, OH |

Vancouver, WA(a)

|

Sydney, Australia(a)

|

||||||

Lancaster, TX |

Valley Forge, PA |

Winsford, United Kingdom (a)

|

||||||

Lawrenceburg, TN |

Visalia, CA |

|||||||

Lebanon, TN (a)

|

Wayne, NJ |

|||||||

Lumberton, NC |

Wausau, WI |

|||||||

Marion, OH |

West Monroe, LA(b)

|

|||||||

Mississauga, Ontario(a)(b)

|

Xenia, OH(a)

|

|||||||

Mitchell, SD |

Winnipeg, Manitoba |

|||||||

Monroe, LA (a)

|

||||||||

Note:

(a) |

Leased facility. | ||||

(b) |

Multiple facilities in this location. | ||||

16

ITEM 3. LEGAL PROCEEDINGS

The Company is a party to a number of lawsuits arising in the ordinary conduct of its business. Although the timing and outcome of these lawsuits cannot be predicted with certainty, the Company does not believe that disposition of these lawsuits will have a material adverse effect on the Company’s consolidated financial position, results of operations or cash flows. See Note 14 in the Notes to Consolidated Financial Statements included herein under “Item 8., Financial Statements and Supplementary Data.”

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable.

17

EXECUTIVE OFFICERS OF THE REGISTRANT

Pursuant to General Instruction G.(3) of Form 10-K, the following list is included as an unnumbered item in Part I of this Report in lieu of being included in the definitive proxy statement that will be filed within 120 days after December 31, 2019.

Michael P. Doss, 53, is the President and Chief Executive Officer of Graphic Packaging Holding Company. Prior to January 1, 2016, Mr. Doss held the position of President and Chief Operating Officer from May 20, 2015 through December 31, 2015 and Chief Operating Officer from January 1, 2014 until May 19, 2015. Prior to these positions he served as the Executive Vice President, Commercial Operations of Graphic Packaging Holding Company. Prior to this Mr. Doss held the position of Senior Vice President, Consumer Packaging Division. Prior to March 2008, he had served as Senior Vice President, Consumer Products Packaging of Graphic Packaging Corporation since September 2006. From July 2000 until September 2006, he was the Vice President of Operations, Universal Packaging Division. Mr. Doss was Director of Web Systems for the Universal Packaging Division prior to his promotion to Vice President of Operations. Since joining Graphic Packaging International Corporation in 1990, Mr. Doss has held positions of increasing management responsibility, including Plant Manager at the Gordonsville, TN and Wausau, WI plants.

Stephen R. Scherger, 55, is the Executive Vice President and Chief Financial Officer of Graphic Packaging Holding Company. From October 1, 2014 through December 31, 2014, Mr. Scherger was the Senior Vice President – Finance. From April 2012 through September 2014, Mr. Scherger served as Senior Vice President, Consumer Packaging Division. Mr. Scherger joined Graphic Packaging Holding Company in April of 2012 from MeadWestvaco Corporation, where he served as President, Beverage and Consumer Electronics. Mr. Scherger was with MeadWestvaco Corporation from 1986 to 2012 and held positions including Vice President, Corporate Strategy; Vice President and General Manager, Beverage Packaging; Vice President and Chief Financial Officer, Papers Group, Vice President Asia Pacific and Latin America, Beverage Packaging, Chief Financial Officer Beverage Packaging and other executive-level positions.

Michael Farrell, 53, became the Executive Vice President, Mills Division of Graphic Packaging Holding Company in September 2018. Prior to that, he served as the Senior Vice President, Supply Chain from January to September 2018. Prior to January 2018, Mr. Farrell served as Vice President, Recycled Board Mills of Graphic Packaging International, LLC and its predecessor companies (“GPI”) from January 1, 2013; and Senior Manufacturing Manager of GPI from October 28, 2009 until December 31, 2012. From December 11, 2008 until October 27, 2009, Mr. Farrell was the Manufacturing Manager of the West Monroe, Louisiana mill and from September 1, 2006 until December 10, 2008 he was the General Manager of the Middletown, Ohio mill of GPI.

Lauren S. Tashma, 53, is the Executive Vice President, General Counsel and Secretary of Graphic Packaging Holding Company. She joined the Company in February 2014. Previously, Ms. Tashma served as Senior Vice President, General Counsel and Secretary of Fortune Brands Home & Security, Inc., where she led the legal, compliance and EHS functions. Prior to that, Ms. Tashma had various roles with Fortune Brands, Inc., including Vice President and Associate General Counsel.

Stacey Valy Panayiotou, 47, is the Executive Vice President, Human Resources of Graphic Packaging Holding Company. She joined the Company on April 22, 2019 from The Coca-Cola Company, where she held a variety of senior HR leadership roles, including Global Vice President of Talent and Development and Vice President, HR, Europe, Middle East & Africa, which consisted of over 120 countries. Prior to her global talent position, Ms. Panayiotou served as Vice President of Talent and Development, Organizational Effectiveness and Diversity and Inclusion and Learning for the Coca-Cola North America Group. Prior to that, she was Vice President of HR for the West business unit of Coca-Cola Enterprises, Inc. (CCE) and worked in corporate HR with The Coca-Cola Company. She also led the organization development function for Pactiv Corporation. Ms. Panayiotou was with The Coca-Cola Company from February 2006 through April 2019.

Hilde Van Moeseke, 49, is the Senior Vice President, Finance Americas, effective January 1, 2020, of Graphic Packaging Holding Company. From July 2017 to December 2019, Ms. Van Moeseke served as an executive officer as Senior Vice President and President, Europe, Middle East and Africa of Graphic Packaging Holding Company. From January 2017 to July 1, 2017, Ms. Van Moeseke served as Vice President, Finance Europe and Interim EMEA Leader of Graphic Packaging International, Inc. From July 2015 until January 2017, Ms. Van Moeseke was the Vice President, Finance Europe of Graphic Packaging International, Inc. Ms. Van Moeseke joined the Company in January 2014 as Director Controlling and was promoted to Director, Finance Europe in July 2014. Prior to January 2014, Ms. Van Moeseke held the position of Group Controller, Project Management, Shared Service Center and Accounting at Azelis Corporate Services S.A. for two years. She has also worked for the Walt Disney Company in Europe for six years in the positions of Director Finance and Controllership, Director Regional Studio Controllership, Regional Studio Controllership and Senior Manager. Ms. Van Moeseke has also served as a member of the Board of Directors for the European Carton Makers Association since September 2018.

18

Joseph P. Yost, 52, is the Executive Vice President, and President, Americas of Graphic Packaging Holding Company. Prior to January 5, 2017, Mr. Yost served as Senior Vice President, Global Beverage and Europe from September 1, 2015 to January 4, 2017, Senior Vice President, Europe from March 1, 2014 to August 31, 2015 and Senior Vice President, European Chief Integration Officer/Chief Financial Officer from February 2013 until February 2014. From 2009 until February 2013, Mr. Yost was the Senior Vice President, Supply Chain of Graphic Packaging Holding Company. From 2006 to 2009, he served as Vice President, Operations Support – Consumer Packaging for Graphic Packaging International, Inc. Mr. Yost has also served in the following positions: Director, Finance and Centralized Services from 2003 to 2006 with Graphic Packaging International, Inc. and from 2000 to 2003 with Graphic Packaging Corporation; Manager, Operations Planning and Analysis – Consumer Products Division from 1999 to 2000 with Graphic Packaging Corporation; and other management positions from 1997 to 1999 with Fort James Corporation.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

GPHC’s common stock is traded on the New York Stock Exchange under the symbol “GPK.” The historical range of the high and low sales price per share and dividend per share declared in each quarter of 2019 and 2018 are as follows:

| Common Stock Market Price | |||||||||||||||||

| High | Low | Dividends Declared | |||||||||||||||

| 2019 | |||||||||||||||||

First Quarter |

$ | 13.19 | $ | 10.54 | $ | 0.075 | |||||||||||

Second Quarter |

14.34 | 12.41 | 0.075 | ||||||||||||||

Third Quarter |

15.43 | 12.62 | 0.075 | ||||||||||||||

Fourth Quarter |

16.95 | 14.06 | 0.075 | ||||||||||||||

| 2018 | |||||||||||||||||

First Quarter |

$ | 16.74 | $ | 14.33 | $ | 0.075 | |||||||||||

Second Quarter |

16.61 | 13.61 | 0.075 | ||||||||||||||

Third Quarter |

15.22 | 13.71 | 0.075 | ||||||||||||||

Fourth Quarter |

14.15 | 10.04 | 0.075 | ||||||||||||||

During 2019 and 2018, GPHC paid cash dividends of $88.7 million and $93.1 million, respectively.

The following presents the Company's share repurchases for the years ended December 31, 2019, 2018, and 2017:

| Amount repurchased in millions | Amount Repurchased | Number of Shares Repurchased | Average Price | |||||||||||

| 2019 | $ | 127.9 | 10,191,257 | (a) |

$ | 12.55 | ||||||||

| 2018 | $ | 120.0 | 10,566,144 | $ | 11.35 | |||||||||

| 2017 | $ | 58.4 | 4,462,263 | (b) |

$ | 13.08 | ||||||||

(a) Includes 7,400,171 shares repurchased under the 2017 share repurchase program, thereby completing that program.

(b) Includes 1,440,697 shares repurchased under the 2015 share repurchase program, thereby completing that program.

During the fourth quarter of 2019, the Company did not repurchase any shares of its common stock. At December 31, 2019, the Company had approximately $462 million of share repurchase authority remaining under the 2019 share repurchase program.

On June 25, 2019, GPIL completed a private offering of $300 million aggregate principal amount of its 4.75% senior unsecured notes due 2027 (the "Senior Notes"). The Senior Notes were sold in a private placement in reliance on Rule 144A and Regulation S under the Securities Exchange Act, as amended. The offering was completed pursuant to a purchase agreement between the Company, GPIL and Field Container Queretaro (USA), L.L.C. and BofA Securities, Inc. as representative of the initial purchasers. The Company received net proceeds of the offering of approximately $295 million, after deducting the initial purchasers' discount and other transaction costs. The net proceeds of the offering were used to repay a portion of the outstanding borrowings under GPIL's revolving credit facility under its senior secured credit facility.

19

On February 4, 2020, there were 1,133 stockholders of record and approximately 36,849 beneficial holders of GPHC's common stock.

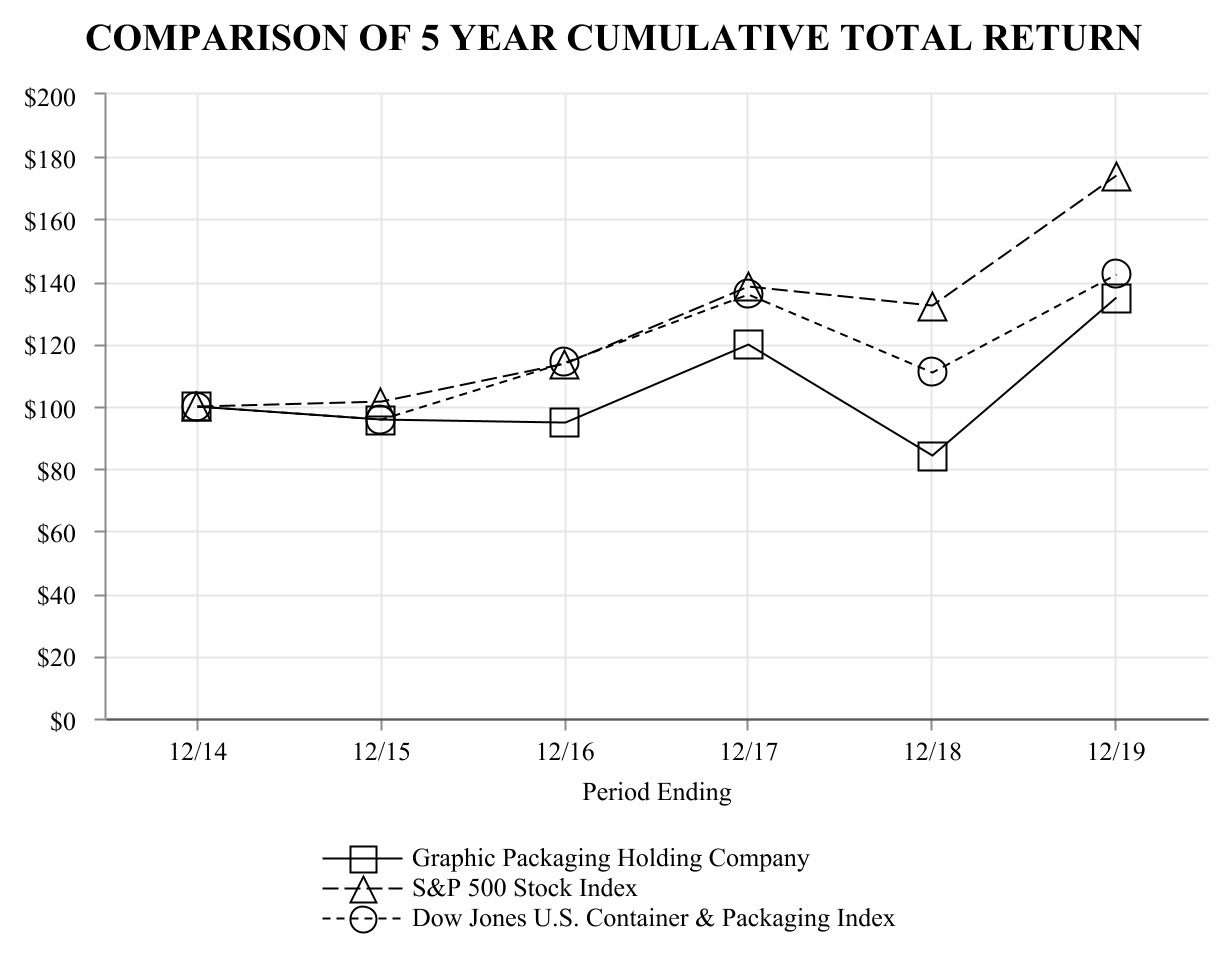

Total Return to Stockholders

The following graph compares the total returns (assuming reinvestment of dividends) of the common stock of Graphic Packaging Holding Company, the Standard & Poor’s (“S&P”) 500 Stock Index and the Dow Jones (“DJ”) U.S. Container & Packaging Index. The graph assumes $100 invested on December 31, 2014 in GPHC’s common stock and each of the indices. The stock price performance on the following graph is not necessarily indicative of future stock price performance.

| 12/31/2014 | 12/31/2015 | 12/31/2016 | 12/31/2017 | 12/31/2018 | 12/31/2019 | ||||||||||||||||||||||||||||||

Graphic Packaging Holding Company |

$ | 100.00 | $ | 95.57 | $ | 94.58 | $ | 119.71 | $ | 84.28 | $ | 134.71 | |||||||||||||||||||||||

S&P 500 Stock Index |

100.00 | 101.38 | 113.51 | 138.29 | 132.23 | 173.86 | |||||||||||||||||||||||||||||

Dow Jones U.S. Container & Packaging Index |

100.00 | 95.69 | 113.93 | 135.60 | 110.58 | 142.19 | |||||||||||||||||||||||||||||

20

ITEM 6. SELECTED FINANCIAL DATA

The selected consolidated financial data set forth below should be read in conjunction with “Item 7., Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements of the Company and the Notes to Consolidated Financial Statements included herein under “Item 8., Financial Statements and Supplementary Data.”

| Year Ended December 31, | |||||||||||||||||

| In millions, except per share amounts | 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||

Statement of Operations Data: |

|||||||||||||||||

| Net Sales | $ | 6,160.1 | $ | 6,029.4 | $ | 4,405.6 | $ | 4,301.0 | $ | 4,163.4 | |||||||

| Income from Operations | 534.1 | 458.2 | 327.9 | 407.4 | 430.1 | ||||||||||||

| Net Income | 278.1 | 294.0 | 300.2 | 228.0 | 230.1 | ||||||||||||

Net Income Attributable to Noncontrolling Interests |

(71.3) | (72.9) | — | — | — | ||||||||||||

| Net Income Attributable to Graphic Packaging Holding Company | 206.8 | 221.1 | 300.2 | 228.0 | 230.1 | ||||||||||||

Net Income Attributable to Graphic Packaging Holding Company Per Share Basis: |

|||||||||||||||||

Basic |

$ | 0.70 | $ | 0.71 | $ | 0.97 | $ | 0.71 | $ | 0.70 | |||||||

Diluted |

$ | 0.70 | $ | 0.71 | $ | 0.96 | $ | 0.71 | $ | 0.70 | |||||||

Balance Sheet Data: |

|||||||||||||||||

(as of period end) |

|||||||||||||||||

Cash and Cash Equivalents |

$ | 152.9 | $ | 70.5 | $ | 67.4 | $ | 59.1 | $ | 54.9 | |||||||

Total Assets |

7,289.9 | 7,059.2 | 4,863.0 | 4,603.4 | 4,256.1 | ||||||||||||

Total Debt |

2,860.3 | 2,957.1 | 2,274.5 | 2,151.9 | 1,875.5 | ||||||||||||

Total Equity |

2,058.0 | 2,018.5 | 1,291.9 | 1,056.5 | 1,101.7 | ||||||||||||

Additional Data: |

|||||||||||||||||

Depreciation and Amortization |

$ | 447.2 | $ | 430.6 | $ | 330.3 | $ | 299.3 | $ | 280.5 | |||||||

Capital Spending, including Packaging Machinery |

352.9 | 395.2 | 260.1 | 294.6 | 244.1 | ||||||||||||

Dividends Declared per Share |

0.30 | 0.30 | 0.30 | 0.225 | 0.20 | ||||||||||||

21

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

INTRODUCTION

This management’s discussion and analysis of financial conditions and results of operations is intended to provide investors with an understanding of the Company’s past performance, financial condition and prospects. The following will be discussed and analyzed:

Overview of Business

Overview of 2019 Results

Results of Operations

Financial Condition, Liquidity and Capital Resources

Critical Accounting Policies

New Accounting Standards

Business Outlook

OVERVIEW OF BUSINESS

The Company’s objective is to strengthen its position as a leading provider of paper-based packaging solutions. To achieve this objective, the Company offers customers its paperboard, cartons, cups, lids, foodservice containers and packaging machines, either as an integrated solution or separately. Cartons, carriers and containers are designed to protect and hold products. Product offerings include a variety of laminated, coated and printed packaging structures that are produced from the Company’s CRB, CUK, and SBS. Innovative designs and combinations of paperboard, films, foils, metallization, holographics and embossing are customized to the individual needs of the customers.

The Company is implementing strategies (i) to expand market share in its current markets and to identify and penetrate new markets; (ii) to capitalize on the Company’s customer relationships, business competencies, and mills and folding carton assets; (iii) to develop and market innovative, sustainable products and applications that benefit from the consumer-led sustainability trends; and (iv) to continue to reduce costs by focusing on operational improvements. The Company’s ability to fully implement its strategies and achieve its objectives may be influenced by a variety of factors, many of which are beyond its control, such as inflation of raw material and other costs, which the Company cannot always pass through to its customers, and the effect of overcapacity in the worldwide paperboard packaging industry.

Significant Factors That Impact the Company’s Business and Results of Operations

Impact of Inflation/Deflation. The Company’s cost of sales consists primarily of energy (including natural gas, fuel oil and electricity), pine and hardwood fiber, chemicals, secondary fibers, purchased paperboard, aluminum foil, ink, plastic films and resins, depreciation expense and labor. Costs increased year over year by $79.1 million in 2019 and increased year over year by $73.6 million in 2018. The higher costs in 2019 were due to labor and benefit costs ($40.4 million), wood ($39.6 million), external board ($12.1 million), partially offset by lower secondary fiber cost ($10.5 million), and other costs, net ($2.5 million).

Because the price of natural gas experiences significant volatility, the Company has entered into contracts designed to manage risks associated with future variability in cash flows caused by changes in the price of natural gas. The Company has entered into natural gas swap contracts to hedge prices for a portion of its expected usage for 2020 and 2021. Since negotiated sales contracts and the market largely determine the pricing for its products, the Company is at times limited in its ability to raise prices and pass through to its customers any inflationary or other cost increases that the Company may incur.

22

Commitment to Cost Reduction. In light of continuing margin pressure throughout the packaging industry, the Company has programs in place that are designed to reduce costs, improve productivity and increase profitability. The Company utilizes a global continuous improvement initiative that uses statistical process control to help design and manage many types of activities, including production and maintenance. This includes a Six Sigma process focused on reducing variable and fixed manufacturing and administrative costs. The Company has expanded the continuous improvement initiative to include the deployment of Lean Sigma principles into manufacturing and supply chain services.

The Company’s ability to continue to successfully implement its business strategies and to realize anticipated savings and operating efficiencies is subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control. If the Company cannot successfully implement the strategic cost reductions or other cost savings plans it may not be able to continue to compete successfully against other manufacturers. In addition, any failure to generate the anticipated efficiencies and savings could adversely affect the Company’s financial results.

Competition and Market Factors. As some products can be packaged in different types of materials, the Company’s sales are affected by competition from other manufacturers’ CRB, CUK, SBS, folding box board, and recycled clay-coated news. Additional substitute products also include plastic, shrink film and corrugated containers. In addition, while the Company has long-term relationships with many of its customers, the underlying contracts may be re-bid or renegotiated from time to time, and the Company may not be successful in renewing on favorable terms or at all. The Company works to maintain market share through efficiency, product innovation and strategic sourcing to its customers; however, pricing and other competitive pressures may occasionally result in the loss of a customer relationship.

In addition, the Company’s sales historically are driven by consumer buying habits in the markets its customers serve. Changes in consumer dietary habits and preferences, increases in the costs of living, unemployment rates, access to credit markets, as well as other macroeconomic factors, may negatively affect consumer spending behavior. New product introductions and promotional activity by the Company’s customers and the Company’s introduction of new packaging products also impact its sales.

Debt Obligations. The Company had an aggregate principal amount of $2,872.8 million of outstanding debt obligations as of December 31, 2019. This debt has consequences for the Company, as it requires a portion of cash flow from operations to be used for the payment of principal and interest, exposes the Company to the risk of increased interest rates and may restrict the Company’s ability to obtain additional financing. Covenants in the Company’s Amended and Restated Credit Agreement, the Term Loan Credit Agreement and Indentures may, among other things, restrict the ability of the Company to dispose of assets, incur guarantee obligations, prepay other indebtedness, repurchase stock, pay dividends, make other restricted payments and make acquisitions or other investments. The Amended and Restated Credit Agreement and the Term Loan Credit Agreement also require compliance with a maximum consolidated leverage ratio and a minimum consolidated interest coverage ratio. The Company’s ability to comply in future periods with the financial covenants will depend on its ongoing financial and operating performance, which in turn will be subject to many other factors, many of which are beyond the Company’s control. See “Covenant Restrictions” in “Financial Condition, Liquidity and Capital Resources” for additional information regarding the Company’s debt obligations.

The debt and the restrictions under the Amended and Restated Credit Agreement, the Term Loan Credit Agreement and the Indentures could limit the Company’s flexibility to respond to changing market conditions and competitive pressures. The outstanding debt obligations and the restrictions may also leave the Company more vulnerable to a downturn in general economic conditions or its business, or unable to carry out capital expenditures that are necessary or important to its growth strategy and productivity improvement programs.

23

OVERVIEW OF RESULTS

This management’s discussion and analysis contains an analysis of Net Sales, Income from Operations and other information relevant to an understanding of the Company's results of operations. On a consolidated basis:

• Net Sales in 2019 increased by $130.7 million or 2.2%, to $6,160.1 million from $6,029.4 million in 2018 due to higher selling prices and the Artistic and 2018 Acquisitions discussed below, partially offset by unfavorable foreign currency exchange rates.

• Income from Operations in 2019 increased by $75.9 million or 16.6%, to $534.1 million from $458.2 million in 2018 due to the higher selling prices, cost savings through continuous improvement programs, benefits from completed capital projects, and the Augusta, Georgia mill outage in 2018. These increases were partially offset by higher inflation, start-up costs associated with the Monroe, Louisiana folding carton facility, the gain on the sale of Santa Clara in 2018, increased incentive costs and unfavorable foreign currency exchange rates.

Acquisitions and Dispositions

•On August 1, 2019, the Company acquired substantially all the assets of Artistic, a diversified producer of folding cartons and CRB. The acquisition included two converting facilities located in Auburn, Indiana and Elgin, Illinois (included in the Americas Paperboard Packaging reportable segment) and one CRB mill located in White Pigeon, Michigan (included in the Paperboard Mills reportable segment).

•During 2018, the Company completed the NACP Combination and the 2018 Acquisitions which included PFP and Letica Foodservice, and sold its previously closed CRB mill site in Santa Clara, California.

•During 2017, the Company completed the 2017 Acquisitions which included Seydaco, Norgraft and Carton Craft.

Capital Allocations

•During 2019, the Company repurchased 10.2 million shares of its outstanding common stock, or approximately $127.9 million, at an average price of $12.55 per share. At December 31, 2019, the Company had approximately $462 million available for additional repurchases under the 2019 share repurchase program.

•During 2019, GPHC declared cash dividends of $87.7 million and paid cash dividends of $88.7 million.

RESULTS OF OPERATIONS

| Year Ended December 31, | |||||||||||

| In millions | 2019 | 2018 | 2017 | ||||||||

| Net Sales | $ | 6,160.1 | $ | 6,029.4 | $ | 4,405.6 | |||||

| Income from Operations | $ | 534.1 | $ | 458.2 | $ | 327.9 | |||||

| Nonoperating Pension and Postretirement Benefit (Expense) Income | (39.5) | 14.9 | 14.8 | ||||||||

| Interest Expense, Net | (140.6) | (123.7) | (89.7) | ||||||||

| Loss on Modification or Extinguishment of Debt | — | (1.9) | — | ||||||||

| Income before Income Taxes and Equity Income of Unconsolidated Entity | $ | 354.0 | $ | 347.5 | $ | 253.0 | |||||

| Income Tax (Expense) Benefit | (76.3) | (54.7) | 45.5 | ||||||||

| Income before Equity Income of Unconsolidated Entity | $ | 277.7 | $ | 292.8 | $ | 298.5 | |||||

| Equity Income of Unconsolidated Entity | 0.4 | 1.2 | 1.7 | ||||||||

| Net Income | $ | 278.1 | $ | 294.0 | $ | 300.2 | |||||

24

2019 COMPARED WITH 2018

Net Sales

The components of the change in Net Sales are as follows:

| Year Ended December 31, | |||||||||||||||||||||||

| Variances | |||||||||||||||||||||||

| In millions |

2018 | Price | Volume/Mix | Foreign Exchange | 2019 | Increase | Percent Change | ||||||||||||||||

Consolidated |

$ | 6,029.4 | $ | 131.2 | $ | 50.2 | $ | (50.7) | $ | 6,160.1 | $ | 130.7 | 2.2 | % | |||||||||